SETTLEMENT

Coordinate effective end-of-day investments by having all your transactions settled in a demand deposit account (DDA). Our DDA accounts provide the means to accommodate settlement of the following transactions:

- Faster payments

- Cash letter

- ACH (Automated clearing house)

- Wire transfer

- Federal Reserve Bank (FRB) vault cash services

- International payments

- Money market

- Discount window / FED borrowing program

- Federal Reserve pass-through account

- Daily cash management sweep

CASH MANAGEMENT SWEEP

Taking advantage of our cash management sweep will provide your community bank with many benefits including:

- Automatic sweep into our Fed Funds program

- Centralized transactions

- Maximize operational efficiency and earning potential

- No FDIC assessment

- Eliminate risk of daylight overdrafts

- Investments of your excess balances

FASTER PAYMENTS

We are your Faster Payments partner. All of our Faster Payments solutions integrate seamlessly with our cash management platform, allowing you to take full advantage of our expertise and solutions.

Right now, we enable full same-day ACH capabilities and provide Funding Agent services to simplify the management of good funds in The Clearing House’s RTP® Network. We’re live with the Federal Reserve Banks’ FedNowSM solution.

FEDERAL RESERVE PASS-THROUGH ACCOUNT

- Uphold your Federal Reserve Bank (FRB) reserve requirement

- Eliminate the need of maintaining an account at the Federal Reserve

- Our Federal Reserve pass-through account will hold any deficiencies in your bank name to meet cash requirements

- Reserve funds are returned to your account at the end of the maintenance period

- Interest earned is posted directly to your account

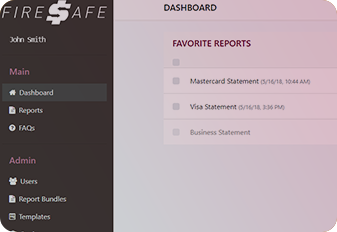

FIRESafe

FIRESafe makes accessing reports a breeze. View and download daily reports and statements all in one place!

OWN.IT™

The stronger your cash letter exchange network, the greater the rewards are for each partner. We invite you to join us and find out what your neighboring banks already know… OWN.IT is the leading network of its kind, exchanging checks internally at Bankers’ Bank, client to client, relaying the benefits to participating institutions across the Midwest. An exchange analysis can be provided upon request, which will analyze your current image exchange clearing costs against possible savings with OWN.IT.

FEDERAL RESERVE BANK

Fed Payments Reporter: banks can participate with BB to use the Fed Payments reporter for a variety of ACH reports.

NEWS AND EVENTS

Real-Time Payments: Why Now Is the Time to Jump In

Explore why real-time payments are transforming banking. Learn how FedNow and RTP growth creates opportunities for community banks to boost efficiency and customer satisfaction.

Read More about Real-Time Payments: Why Now Is the Time to Jump In

Modernizing Foreign Check Clearing: Smarter Solutions for Community Banks

Discover scalable solutions for foreign check clearing. Learn how community banks can modernize processes with image capture, remote deposit, and cost-effective manual options.

Read More about Modernizing Foreign Check Clearing: Smarter Solutions for Community Banks

Fedwire’s Big Upgrade: What ISO 20022 Means for Your Wire Transfers

Fedwire’s switch to ISO 20022 brings faster, more accurate wire transfers with richer data and better compliance tools—helping community banks streamline operations and prepare for the future of payments.

Read More about Fedwire’s Big Upgrade: What ISO 20022 Means for Your Wire Transfers

Testimonial

Contact Us To Get Started

Contact A Rep

- (800) 388-5550

YOU MAY ALSO BE INTERESTED IN

-

Agency Lending Placement

-

FedNow & RTP Settlement Solutions

-

Risk Management Solutions

-

Commercial Loan Transaction NotificationYou are about to generate a secure email to submit a commercial loan payment or draw request. This system can only accept commercial loan transactions from an authorized community bank for commercial loans serviced by Bankers’ Bank.

-

Online AccessYou have unlimited access to all of your account information and can safely originate and receive transactions utilizing our secure web-based communication tools.