The Impact of Instant Payments in 2024: Growth and Opportunities for Community Banks

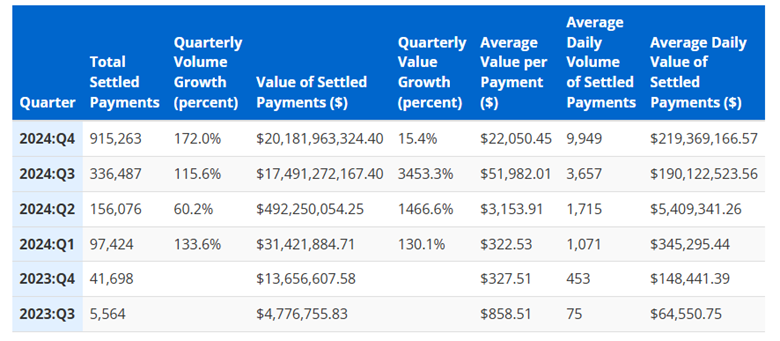

In 2024, instant payments made a significant impact in the US. As FedNow approached its first anniversary, over 900 financial institutions (FIs) were live on the network, with predictions of surpassing 1,150 FIs. The RTP network also grew from over 370 participants in September 2023 to around 760 by December 2024. Bankers’ Bank saw growth on both networks and an increase in Send dialogue. The Federal Reserve announced Q4 2024 numbers, visit the FedNow Service – Quarterly Statistics website¹.

The rise in “average value per payment” from Q2 to Q3 indicates large dollar sends during Q3 2024. This could be attributed to real estate disbursements via a title company connected to FedNow, or lower value intrabank payments taking place on FedNow instead of Fedwire. It is notable that daily volume increased by 172% between Q3 and Q4.

On January 8, 2025, The Clearing House reported a 38% increase in platform volume for 2024, reaching 343 million transactions and a record 98 million transactions valued at $80 billion in Q4 alone. The network now averages over 1 million payments per day, with 42% occurring on weekends, overnight, or holidays. More than 285,000 businesses use the RTP network monthly for business-to-business transactions through Fis in the system.

On February 9, 2025, the RTP maximum transaction limit will increase from $1 million to $10 million. It is reasonable to think the FRB is considering the maximum transaction limit increase for FedNow. What will the new limit be and when? FedNow could see a limit increase between $3 million to $7 million later in 2025 or early 2026.

This presents an opportunity for banks to provide instant payments settlement, and it’s essential to discuss such plans with Bankers’ Bank, which is ready for larger settlement amounts. Banks can gain internal operational efficiencies with straight-through processing and save time and money by sending lower value intrabank payments via instant payment (finality payment, confirmation of receipt).

In 2024, Bankers’ Bank settled $101,119,786.77 via FedNow and RTP across 175,009 individual credits, averaging $577.79 per credit, marking 123% growth in settlement dollars and 77% growth in individual credits compared to 2023. The largest settlement credit in 2024 was $660,000 on the RTP network. Increased activity is driven by a growing number of senders on both networks.

If you’re unsure about instant payments or transitioning to 7-day accounting, Bankers’ Bank is here to assist. Reach out to your Correspondent Banker to schedule an appointment.

Sources: